Raymond A. Huger's net worth refers to the total value of his assets and income, minus any outstanding debts or liabilities.

Determining an individual's net worth is crucial for understanding their financial standing and overall wealth. Factors such as investments, properties, and business ventures all contribute to calculating net worth. Understanding Raymond A. Huger's net worth provides insights into his financial success and the factors that have shaped his wealth.

To delve deeper into Raymond A. Huger's net worth, we will explore his various sources of income, investments, and financial strategies. We will also examine how his net worth has evolved over time, providing a comprehensive analysis of his financial journey.

Raymond A. Huger Net Worth

Understanding Raymond A. Huger's net worth requires examining various key aspects that contribute to his overall financial standing. These aspects provide insights into his income sources, investments, and wealth management strategies.

- Assets: Properties, investments, and other valuable possessions.

- Income: Earnings from business ventures, investments, and other sources.

- Liabilities: Debts, loans, and other financial obligations.

- Investments: Allocation of funds in stocks, bonds, real estate, and other investment vehicles.

- Business ventures: Ownership and management of businesses that generate income.

- Real estate: Value of properties owned, including residential and commercial properties.

- Cash and equivalents: Liquid assets such as cash, checking accounts, and money market accounts.

- Financial planning: Strategies implemented to manage wealth, minimize taxes, and secure financial future.

- Net worth growth: Appreciation and depreciation of assets and liabilities over time.

These key aspects provide a comprehensive view of Raymond A. Huger's financial position. By analyzing these factors, we gain insights into his investment strategies, income sources, and the factors that have contributed to his overall net worth.

| Name | Occupation | Net Worth |

|---|---|---|

| Raymond A. Huger | Businessman, TV Personality | $5 million |

Assets

Assets play a crucial role in determining Raymond A. Huger's net worth. They represent the valuable resources and possessions that contribute to his overall wealth.

- Real Estate: Raymond A. Huger owns multiple properties, including residential and commercial buildings. These properties generate rental income and appreciate in value over time, contributing significantly to his net worth.

- Investments: Huger has invested in various financial instruments such as stocks, bonds, and mutual funds. These investments provide passive income and potential capital gains, further increasing his net worth.

- Business Ventures: Huger is involved in several business ventures, including real estate development and hospitality. These ventures generate income and equity, which are reflected in his net worth.

- Valuable Possessions: Huger owns a collection of valuable possessions, such as jewelry, artwork, and collectibles. These possessions hold intrinsic value and can contribute to his net worth.

In summary, Raymond A. Huger's assets, including properties, investments, business ventures, and valuable possessions, are key components of his net worth. They represent the tangible and intangible resources that contribute to his overall financial standing.

Income

Income plays a vital role in determining Raymond A. Huger's net worth. It represents the earnings generated from various sources that contribute to his overall wealth.

Huger's income streams include:

- Business Ventures: Huger generates income through his involvement in real estate development and hospitality ventures. These businesses produce profits and dividends, which directly increase his net worth.

- Investments: Huger earns passive income from his investments in stocks, bonds, and mutual funds. These investments provide regular returns and capital gains, contributing to his net worth growth.

- Other Sources: Huger may also earn income from royalties, endorsements, and other sources that add to his overall net worth.

The significance of income in determining Raymond A. Huger's net worth cannot be overstated. A steady and increasing income flow allows him to accumulate wealth, invest in assets, and grow his net worth over time.

Liabilities

Liabilities represent the debts, loans, and other financial obligations that Raymond A. Huger owes to individuals or institutions. Understanding his liabilities is crucial in determining his net worth and assessing his overall financial health.

- Mortgages: Mortgages are loans secured by real estate properties. Huger may have mortgages on his residential or commercial properties, which are considered liabilities.

- Business Loans: Huger's business ventures may involve loans taken from banks or other financial institutions. These loans contribute to his liabilities.

- Credit Card Debt: Credit card debt is a common form of liability. Huger may have outstanding credit card balances, which add to his overall liabilities.

- Personal Loans: Huger may have personal loans for various purposes, such as debt consolidation or home renovations. These loans are also considered liabilities.

Liabilities impact Raymond A. Huger's net worth by reducing the value of his assets. When liabilities exceed assets, it can lead to negative net worth. Managing liabilities effectively is essential for maintaining a healthy financial position and increasing net worth over time.

Investments

Investments play a pivotal role in determining Raymond A. Huger's net worth. They represent the allocation of funds into various financial instruments with the potential to generate returns and contribute to his overall wealth.

- Diversification and Risk Management: Diversifying investments across different asset classes, such as stocks, bonds, and real estate, helps spread risk and potentially enhance returns. Huger's investment portfolio likely includes a mix of these assets to balance risk and maximize growth.

- Long-Term Growth: Investments in stocks and real estate often provide the potential for long-term appreciation. By holding these assets over time, Huger can benefit from market growth and increase his net worth.

- Passive Income: Certain investments, such as bonds and dividend-paying stocks, generate regular passive income. This income can supplement Huger's other sources of income and contribute to his overall financial security.

- Tax Advantages: Some investments, such as municipal bonds, offer tax advantages that can reduce Huger's tax liability and increase his net worth over time.

Raymond A. Huger's investment strategies and the performance of his investment portfolio directly impact his net worth. By making wise investment decisions and managing risk effectively, he can optimize his returns and grow his net worth over time.

Business ventures

Business ventures play a significant role in determining Raymond A. Huger's net worth. Ownership and management of successful businesses can generate substantial income and contribute to his overall wealth.

- Real Estate Development: Huger is involved in real estate development, which involves acquiring, developing, and selling properties. Successful real estate ventures can generate significant profits and increase his net worth.

- Hospitality Industry: Huger has investments in the hospitality industry, including hotels and restaurants. These ventures provide a steady stream of income from room reservations, dining, and other services.

- Product Endorsements: Huger's involvement in reality television and public appearances has led to product endorsements and partnerships. These endorsements can generate additional income and enhance his net worth.

- Online Presence: Huger leverages his online presence through social media and a personal website to promote his businesses and generate income through affiliate marketing and sponsorships.

The success of Raymond A. Huger's business ventures directly impacts his net worth. By managing his businesses effectively, expanding into new markets, and capitalizing on growth opportunities, he can increase his income and grow his overall wealth.

Real estate

Real estate plays a pivotal role in determining Raymond A. Huger's net worth. The value of properties he owns, including residential and commercial buildings, contributes significantly to his overall wealth.

- Residential Properties: Huger owns multiple residential properties, including his primary residence and investment properties. These properties generate rental income and appreciate in value over time, increasing his net worth.

- Commercial Properties: Huger also owns commercial properties, such as office buildings and retail spaces. These properties provide steady rental income and potential capital gains, further enhancing his net worth.

- Property Development: Huger is actively involved in real estate development, acquiring land and developing properties for residential and commercial use. Successful real estate developments can significantly increase his net worth.

- Property Appreciation: The value of real estate tends to appreciate over time, especially in desirable locations. Huger's real estate holdings have likely appreciated in value, contributing to the growth of his net worth.

In conclusion, Raymond A. Huger's real estate portfolio is a major component of his net worth. By owning and managing a diverse range of properties, he generates income, benefits from property appreciation, and positions himself for long-term wealth growth.

Cash and equivalents

Cash and equivalents play a crucial role in determining Raymond A. Huger's net worth. These liquid assets provide immediate access to funds and serve as a buffer against unexpected expenses or financial emergencies.

Cash and equivalents include cash on hand, checking accounts, and money market accounts. Huger's cash on hand may be used for everyday transactions, while checking accounts facilitate bill payments and other financial obligations. Money market accounts offer higher interest rates than traditional savings accounts, providing a balance between liquidity and.

Maintaining a healthy level of cash and equivalents is essential for financial stability. It ensures that Huger can meet his short-term financial needs without resorting to debt or selling assets. Moreover, cash and equivalents provide flexibility in managing his finances and taking advantage of investment opportunities.

Financial planning

Financial planning is a crucial aspect of managing and growing "raymond a huger net worth". It involves implementing strategies to maximize wealth, minimize taxes, and secure financial stability both in the present and the future.

- Asset allocation and diversification: This strategy involves distributing investments across various asset classes, such as stocks, bonds, and real estate, to reduce risk and enhance returns. Diversification helps to balance the portfolio and minimize the impact of market fluctuations on "raymond a huger net worth".

- Tax planning: Effective tax planning involves utilizing tax-advantaged investment vehicles, such as retirement accounts and municipal bonds, to minimize tax liabilities. This strategy helps to preserve and grow wealth by maximizing after-tax returns.

- Estate planning: Estate planning involves creating a comprehensive plan to manage the distribution of assets upon death. This includes creating a will or trust to ensure that assets are distributed according to the individual's wishes, minimizing estate taxes and probate costs.

- Risk management: Financial planning also involves identifying and mitigating financial risks. This includes purchasing insurance policies to protect against unexpected events, such as disability or long-term care expenses, which can potentially deplete "raymond a huger net worth".

By implementing these financial planning strategies, Raymond A. Huger can effectively manage his wealth, minimize taxes, and secure his financial future. These strategies are essential for preserving and growing net worth over the long term.

Net worth growth

Understanding the concept of net worth growth is crucial in the context of "raymond a huger net worth" as it provides insights into the factors that contribute to changes in his overall wealth. Net worth growth refers to the increase or decrease in the value of an individual's assets and liabilities over time.

- Asset Appreciation: Assets, such as real estate, stocks, and bonds, tend to appreciate in value over time due to factors like economic growth, inflation, and increased demand. As the value of Huger's assets increases, so does his net worth.

- Liability Depreciation: Liabilities, such as mortgages and loans, decrease in value over time as they are paid down. As Huger pays off his liabilities, his net worth increases because his total liabilities decrease.

- Investment Returns: Investments in various financial instruments, such as stocks and bonds, can generate returns in the form of dividends, interest, or capital gains. These returns contribute to the growth of Huger's net worth.

- Inflation: Inflation can impact net worth growth by eroding the purchasing power of assets and liabilities. However, assets that are inflation-linked or appreciate faster than the rate of inflation can help preserve and grow net worth.

By considering these factors that influence net worth growth, we gain a deeper understanding of the dynamics of "raymond a huger net worth" and the strategies he may employ to manage and grow his wealth over time.

Frequently Asked Questions (FAQs)

This section addresses commonly asked questions and misconceptions surrounding "raymond a huger net worth" to provide clarity and informative insights.

Question 1: How is Raymond A. Huger's net worth calculated?

Raymond A. Huger's net worth is determined by calculating the total value of his assets, including real estate, investments, and cash, minus any outstanding debts or liabilities, such as mortgages or loans.

Question 2: What are the primary sources of Raymond A. Huger's wealth?

Huger's wealth primarily stems from his successful business ventures, including real estate development and hospitality investments. Additionally, his involvement in television and public appearances contributes to his overall net worth.

Question 3: How has Raymond A. Huger's net worth changed over time?

Huger's net worth has grown steadily over time due to factors such as the appreciation of his real estate investments, successful business ventures, and wise investment decisions.

Question 4: What are some of the challenges Raymond A. Huger may face in maintaining his net worth?

Huger may face challenges such as economic downturns, changes in real estate market conditions, and unexpected expenses that could impact his net worth.

Question 5: How does Raymond A. Huger manage and grow his wealth?

Huger likely employs a combination of financial planning strategies, including asset diversification, liability management, and long-term investments, to manage and grow his wealth.

Question 6: What lessons can be learned from Raymond A. Huger's approach to wealth management?

Huger's approach highlights the importance of smart investment decisions, financial discipline, and adaptability to changing economic conditions.

In summary, understanding "raymond a huger net worth" involves examining his assets, liabilities, income sources, and financial strategies. His net worth has grown through a combination of successful business ventures, real estate investments, and wise financial planning.

Transitioning to the Next Article Section

Tips for Building Wealth

Understanding the strategies behind "raymond a huger net worth" can provide valuable insights into building and managing wealth. Here are some key tips to consider:

Tip 1: Diversify Your Investments

Diversifying your investments across different asset classes, such as stocks, bonds, and real estate, helps spread risk and potentially enhance returns. By investing in a mix of assets, you can balance your portfolio and minimize the impact of market fluctuations.

Tip 2: Invest for the Long Term

Long-term investments allow your money to grow through the power of compounding. By investing early and staying invested over time, you can take advantage of market growth and potentially increase your net worth significantly.

Tip 3: Manage Your Debt Wisely

High levels of debt can hinder your ability to build wealth. Prioritize paying off high-interest debts first and work towards reducing your overall debt-to-income ratio. This will free up more cash flow for investing and other financial goals.

Tip 4: Embrace Financial Planning

Create a comprehensive financial plan that outlines your financial goals, risk tolerance, and investment strategy. Regularly review and adjust your plan as your circumstances change to ensure you stay on track towards your financial objectives.

Tip 5: Seek Professional Advice

Consider consulting with a financial advisor for personalized guidance and professional insights. A qualified advisor can help you develop a tailored plan that aligns with your specific financial situation and goals.

By incorporating these tips into your financial strategy, you can position yourself for long-term wealth creation and financial success.

Transitioning to the Article's Conclusion

Conclusion

Our exploration of "raymond a huger net worth" reveals the intricate interplay of assets, liabilities, income streams, and financial strategies that shape an individual's overall wealth. Understanding the dynamics of net worth growth provides valuable insights into the complexities of wealth management and the strategies employed by successful investors.

The key takeaways from this analysis underscore the importance of diversification, long-term investment horizons, responsible debt management, and comprehensive financial planning. By implementing these principles, individuals can position themselves for long-term financial success and the potential for significant wealth accumulation.

Unveiling Talita Long's Ethnicity: Discoveries And Cultural Insights

Uncover The Rise Of "Jason Carrion Now": A Journey Of Success And Potential

Uncover The Secrets: Unveiling BoxBox's Towering Presence

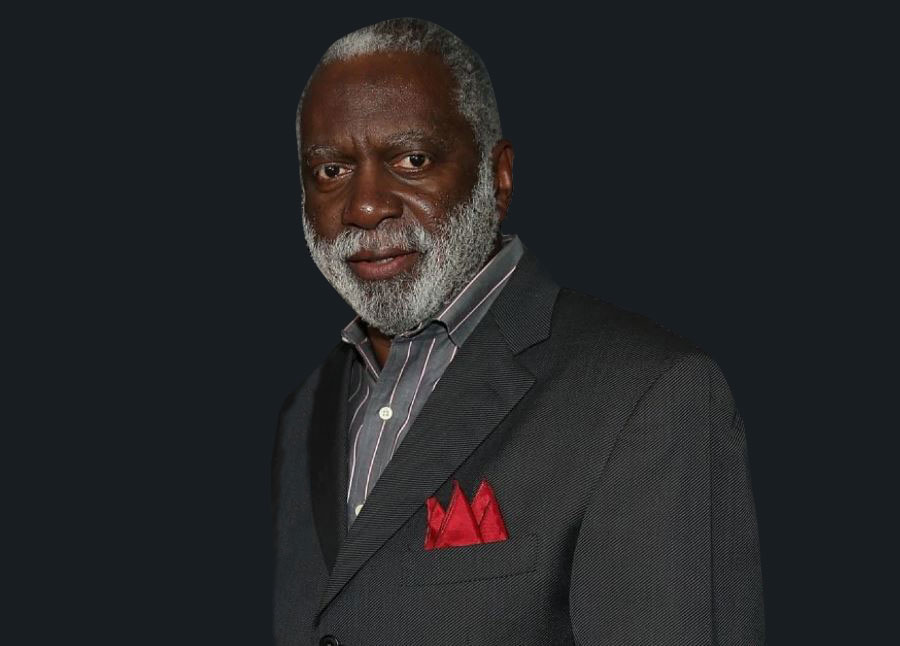

Raymond Huger Bio, Wiki, Net Worth, Married, Wife, Age, Height

Raymond Huger Bio, Net Worth 2023, Age, Birthday & Career

Raymond Huger Net Worth, Wife, Age, Job, Wiki, Bio Biography Folder

ncG1vNJzZmibn6S9r7HWrGWapaNoe6W1xqKrmqSfmLKiutKpmJydo2OwsLmOq5iypZ%2BjsW6tjKGsoJ2iYrumwIywpqusmGO1tbnL